Research

Volatility, Intermediaries, and Exchange Rates

with Xiang Fang

Journal of Financial Economics

-

An estimated quantitative exchange rates model in which the market participants are intermediaries subject to value-at-risk constraints

-

Resolve exchange rate puzzles (Backus-Smith, forward premium, volatility, CIP deviation)

-

implications on vol, intermediary, and fx consistent with the data

Cubist Systematic Strategies PhD Candidate Award for Outstanding Research, Western Finance Association

AEA, Cavalcade Asia, EFA, ES Winter, ES European, FIRS, MFA, WFA, Penn, PKU, SJTU, Wharton

Government Policy Approval and Exchange Rates

with Ivan Shaliastovich

Journal of Financial Economics

-

Measures of U.S. government policy approval are strongly related to the dollar (correlation 50%)

-

High approval forecasts a decline in the dollar risk premium, a persistent increase in economic growth, and a reduction in future economic volatility

AFA, Cavalcade, EFA, MFA, WFA, Front Range Seminar, ITAM Conference, VSFX, ASU, BI, HKU, Luxemburg School of Finance, NUS, SMU, UT-Dallas, UW-Madison

with Riccardo Colacito, Mariano Croce, and Ivan Shaliastovich

Review of Financial Studies

-

Assess international propagation of output volatility shocks to macroeconomic aggregates and equity prices

-

An increase in country’s output volatility is associated with a decrease in its output, consumption, and net exports

-

The average consumption pass-through is 50% (a 1% increase in output volatility increases consumption volatility by 0.5%)

-

A novel channel of recursive risk sharing of volatility risks explains the finding

Best Paper Award, Annual Conference in International Finance

AEA, CEPR Gerzensee, ES Winter, SED, WFA, Annual Conference in International Finance, BoC Workshop, Chicago International Macro Finance, Conference on Uncertainty, SAFE Workshop, Stanford SITE, SoFiE, UBC Winter, Columbia, Chicago Fed, Erasmus, Indiana, SF Fed, Tilburg, Virginia, Wharton

Government Debt and Risk Premia

Journal of Monetary Economics

-

Risk premia increase with government debt

-

Debt-to-GDP ratios positively predict risk premia at short and long horizons, in the U.S. and other advanced economies

-

Higher debt is associated with higher bond and credit risk premia and lower risk-free rates

-

During high-debt periods, fiscal policy becomes uncertain and ineffective and leads to debt crises

-

An equilibrium model quantifies these mechanisms

EFA, Conference on Uncertainty, HK Joint Workshop, SoFiE, UMich Mitsui Symposium, World Symposium on Investment Research, BlackRock, CUHK, CUHK-Shenzhen, Philly Fed, Goldman Sachs, NTU, Penn, SSE, Tsinghua PBC, HKU, UW-Madison, Wharton

With Doron Avramov, Abraham Lioui, and Andrea Tarelli

Management Science

-

A conditional asset pricing model that integrates ESG demand and supply dynamics

-

Green assets exhibit positive exposure to ESG demand shocks, hence commanding higher premia

-

Time-varying convenience yield leads to lower expected returns for green assets

-

ESG demand shocks have positive contemporaneous effects on unexpected returns, contributing to large positive payoffs in the green-minus-brown portfolio over extended horizons

Getting to the Core: Inflation Risks Within and Across Asset Classes

with Xiang Fang and Nikolai Roussanov

Review of Financial Studies

-

Core inflation betas of stocks are negative while energy betas are positive

-

currencies, commodities, and real estate also mostly hedge against energy inflation but not core

-

only core inflation carries a negative risk premium

-

The relative contribution of core and energy helps explain the time-varying correlation between stock and bond returns

-

a two-sector New Keynesian model qualitatively accounts for these facts

NBER LTAM, CICF, EFA, FIRS, MFA, SED, ABFER, ASU Sonoran, Triangle Macro-Finance, VSFX, JHU Conference, Utah Winter, HKU, Kellogg, Wharton

Volatility (Dis)Connect in International Markets

with Riccardo Colacito, Mariano Croce, and Ivan Shaliastovich

Management Science

-

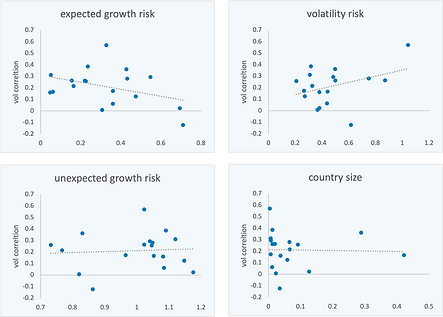

Evidence for the (dis)connect between the volatilities, as opposed to the levels, of consumption differentials and real exchange rates

-

Volatility correlations are below one, but they are larger than the level correlations

-

Volatility disconnect weakens for countries with low amount of expected growth risk and high amount of volatility risk

EFA, MFA, UNSW conference

with Ivan Shaliastovich

Journal of Finance

-

Elections and State of the Union addresses by the U.S. President announce government policy agenda

-

Stock market returns on announcement days are about 10-20 times larger than on other days and show pre-announcement drift

-

Announcement returns increase in adverse economic, political and high volatility times

-

Overall evidence supports the risk premium/uncertainty resolution channel for announcement effects

EFA, CICF, NFA, UNSW conference

with Lukas Schmid and Amir Yaron

-

Empirically document and theoretically evaluate a dual role for government debt

-

An increase in government debt improves liquidity and lowers liquidity premia, while it creates policy uncertainty and raises default risk premia

-

Interpret and quantitatively evaluate these two channels through a general equilibrium model with risk-sensitive agents subject to liquidity shocks

-

Increasing safe asset supply can be risky

NBER AP, NBER SI Capital Markets, AFA, EFA, Cavalcade, Cavalcade Asia, CEPR Gerzensee, CICF, SED, Backus Memorial Conference, CEPR Fiscal Policy, Finance Down Under, LBS Symposium, Fed STFM, Red Rock, South Carolina FIFI, Stanford SITE, UBC Winter, ASU, ETH Zurich, Tilburg, UZurich